Payroll shouldn't

be this hard

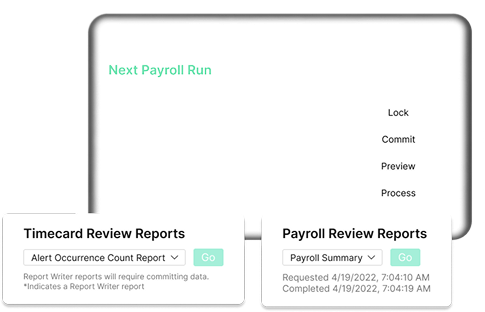

Between calculating taxes, managing deductions, filing reports, and keeping up with compliance changes, payroll can consume hours of your week. One mistake can lead to penalties, unhappy employees, and sleepless nights. There has to be a better way.

Benefits List:

Manual calculations lead to costly errors

Multi-state compliance is overwhelming

Employees constantly ask about pay stubs and W-2s

Tax filing deadlines create constant stress

Disconnected systems mean duplicate data entry

Year-end reporting takes weeks to complete